The government is launching a new scheme called ‘Tax Free Childcare’ which has the aim of helping working parents with their childcare costs.

In the UK the average cost of sending a child under the age of two to nursery can range from around £115 to £220 per week depending on if the parent is part time or full time. The cost of this often means that it simply isn’t feasible for both parents to work full time whilst they have young children.

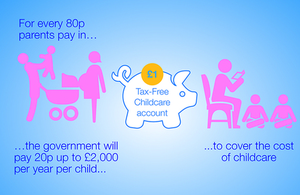

The government are aiming to help working parents by offering to pay £1 for every £4 paid by the parents towards childcare. A total of £2,000 can be received each year per child up to the age of 12, this changes slightly for disable children as £4,000 a year can be received up to the age of 17.

To be eligible for the scheme parents must earn at least £115 each and not in excess of £100,000 each. The scheme will be launched in early 2017 with parents with the youngest children able to apply and benefit from the scheme first. By the end of 2017 the scheme will be available to all eligible working parents in the UK.

The scheme currently in place is the Employer-Supported Childcare scheme. From this you can receive up to £55 per week for childcare depending on how much you earn and how long you have been on the scheme. However, unlike the current scheme, with Tax Free Childcare self-employed parents will also be able to take advantage of the new scheme, so this is definitely something to look out for in 2017.

There are other ways of gaining help to pay for childcare such as salary sacrifice schemes through payroll, Child Tax Credits, Working Tax Credits, Free Childcare and Education for 2 – 4 year olds and also schemes to help whilst you are at college or university. A lot of helpful information can be found on the following link, or if you would like more information regarding eligibility for different schemes then please feel free to contact us.

https://www.gov.uk/help-with-childcare-costs/approved-childcare